The Pooya Core System for International Banking Affairs

More than 2 decades have passed since the first version of the “Pooya core system for International Banking Affairs” was generated. The system covers all common foreign currency processes of the operational units (branches, dependant or independent foreign currency affair units), as well as covering the foreign currency processes of the Iranian International banking affairs offices while meeting the requirements of the Central Bank of Iran.

In its evolutionary development, the system has been able to comply with the latest banking requirements in the business process phase, by using the knowledge of banking experts. Also considering the technical aspect, the system has grown, using research and development and new IT outcomes. Today the largest Iranian banks are utilizing this system for their foreign affairs.

The Pooya core system for international banking affairs has been successful in complying with different bank employer needs in the last 20 years. And according to Banking International affairs managers in Iran, this system is the best in its being comprehensive and its ease in performing foreign currency processes. (There are no competitors)

The role of the software system in providing foreign currency services

Foreign currency Services is the most profitable section of banking services and in order for the services to have the best results, banks must focus on the main features of this business. Some of these features are as follows:

- Following highly diverse regulations, approved by the central bank of Iran and other political and regulatory authorities

- Providing and sending updated, detailed and reliable reports as needed, for the central bank

- Complying with sophisticated banking affairs and the variety of banking processes and instructions

- Supporting changes in international banking regulations

- Responding to and fulfilling the needs of bank clients

An entirely professional software system for foreign currency affairs, is needed to respond to the mentioned features. This system should be comprehensive in responding to all banking needs in addition to being flexible and up to date with today’s technology.

In the Iranian banking system, local currency and foreign currency services are managed and offered in entirely separate, independent sections. Their interaction is limited to the following processes:

Withdrawing from client banking accounts during the day in the local currency for the provided foreign currency services and sending (transferring) the summary of the foreign currency operations to the General Ledger system at the end of the day to keep the bank book keeping functions integrated.

The separation between the foreign and local currency sections has enabled banks more freedom in choosing a system based on the following characteristics:

- Quality and comprehensiveness of the system processes

- Adoption to the needs of banking international affairs

- The speed and accuracy in providing reports for regulatory entities such as the Central Bank of Iran (ITRS, Samtak, Commitments & facilities of 28x reports, etc.) and the Economic and Asset Ministry

- Compatibility with the foreign currency policies that change according to daily circumstances

- Ability to make speedy changes

Features

Integrity

- The information data base system is centralized

- Different sub-systems are practically integrated and connected

- Different sub-systems are centralized in the core servers and all users receive services from one window

- Various subsystem processes are integrated

Modularity

- Consisting of several subsystems based on the task separation in the foreign currency sections of banks.

- Ease in implementation, installation, commissioning and training the system

- Ease in trouble shooting, modification, and technical support

- Ability of gradually implementing the system based on the authorized limit on foreign currency banking services

Process based

- Dividing up services in groups of activities

- Analyzing and implementing each activity independently

- Ability to define each unit’s task by putting together necessary activities

Parametric

- Ease of making most modifications via system parameters

- Defining many calculating items parametrically; such as tariffs, coefficients, etc.

- Defining many controlling factors parametrically

Multilingual

- Ability to combine Farsi and Latin texts

- Defining Latin pages when most expressions are Latin

Reliability

- Strict and automatic controlling in carrying out issued directives, instructions, and regulations

- Ability to set priorities in performing operations and controlling them via the system

- Defining the format for accounting documents, in order to prevent errors in recording the documents

Connecting to Swift and the Currency based Financial Electronic Messaging system (Sepam)

- Ability to receive messages from Swift and generate swift messages in accordance to regulated formats

- Generating messages in accordance to the Sepam format

Access to digital documentations in user pages

Context sensitive user guidance

Designing and implementing using a service oriented architecture (SOA) and interaction based on services and events

Independency from the operating environment in servers and user workstations

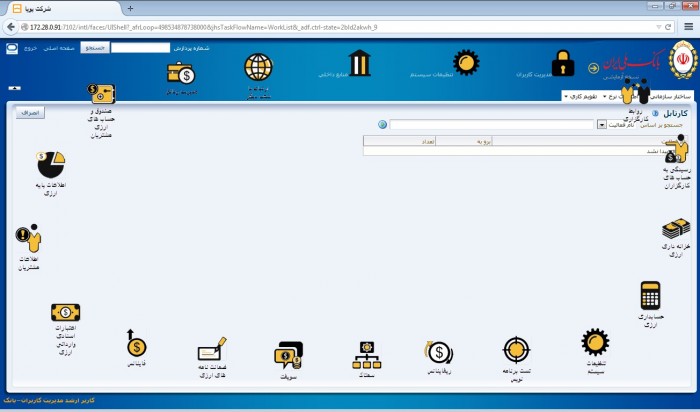

Having an enterprise design and web based implementation

Using business intelligence analysis

Advantages

- Integration all through the bank

- Supervision on performing approved rules and regulations

- Less need for professional employees in the foreign currency affairs

- Ease and speed in performing organizational tasks for users

- Providing required reports ASAP and in real time

- Identifying client records and operations (deposits, commitments, and liabilities)

- Controlling banking liabilities towards agents and fund management

- Controlling agent bank balances

- Corresponding banking statistics (system reports) with the financial system booking records due to mechanized issuance of accounting documents

- Generating reports and information required by banks: Foreign currency open items status reports, Foreign currency balance reports, Bank guarantees, Sending Samtak information and ITRS automatically

- Generating customers credit information files for customers comprehensive data base and bank guarantees of the Ministry of Economic and Finance

- Recording comprehensive and complete information from clients credit and facility profiles

- The mechanized issuance of accounting documents while processes are being performed and clients are recording information

Modules

The Pooya Foreign Currency System covers all foreign currency processes taking place in bank branches, exchange units, and related headquarter offices. The subsystems of the Pooya Foreign Currency System generally include:

- Cash, buying and Selling, money transfers, client foreign currency accounts

- Accounting(foreign currency)

- Agent relations and assessing the statements

- Importing goods and services (importing order registrations, letter of credit/promissory notes, and commercial money transfers)

- Currency deals(Exchange)

- Treasury (Foreign Currencies)

- Letter of guarantee (foreign currencies)

- Finance

- Refinance

- Loans-internal resources

- Loans – reserved resources (Hesabe Zakhireh Arzi)

- Loan – national development account (Sandogh Zakhireh Arzi)

- Following up and collecting debt settlements

- Pledge handling

- CIF(Customer Information File)

- Foreign branches

Independent Side Systems

The Foreign Currency System is designed in a way that some parts of its subsystems are capable of being used independently along with any other foreign currency system. This cluster of systems which is the daily need of every Iranian bank system is called the independent side system. The cluster includes:

- The business intelligence system

- The banking facility and 28x liability system

- The Samtak system

- The ITRS system

- The SWIFTt system

- The user informing system

- The documentation management system

If for any reason banks do not want to use all the subsystems of the Foreign Currency System, but request any of the independent lateral Systems, they can be used along with the bank existing systems.

Technology

- Web-based

- Service-based

- Centralized

Security

- Secure communication between workstations and system servers Through the SSL and HTTPS protocols

- Heeding security concerns at the application layer

Including:

- Controlling the user access to system processes and their functions (generating, modifying, deleting and displaying information).

- Inserting the work calendar including; weekly/yearly holidays, in order to control the dates of accounting document issuances

- Planning and controlling the authorized days and hours of user access to the system

- Storing encrypted passwords

- Capability of defining certain limits on the existing accounts in the system

- Considering security concerns in the database layer

Protecting the database servers against misuses and preventing unauthorized access to the system, by authenticating clients.